capital gains tax budget news

Once again no change to CGT rates was announced which actually came as no surprise. The IRS taxes short-term capital gains like ordinary income.

The London Mayor made his response to another Labour politician - Sam Moema - who was speaking out against the levels of overseas ownership of buy to let and other properties in the capital.

. TOKYO Reuters -Japanese Prime Minister Fumio Kishida said on Friday his government and ruling coalition continued to debate capital gains tax as one of the issues keeping alive an idea once. The rates do not stop there. Bidens 58 trillion budget proposal includes a tax on unrealized gains meaning some Americans would have to pay for the appreciation of assets like stocks even before they sell those assets.

FAIRA seeks Centre to bring down short-term capital gains tax in budget PTI Jan 30 2022 1536 IST Budget 2022. Filers paid hundreds of billions more in taxes for 2021 and surging capital gains may have been to blame according to an analysis from the Penn Wharton Budget Model. The Washington Capital Gains Tax Changes Initiative 1934-1938 may appear on the ballot in Washington as an Initiative to the People a type of.

Currently returns from listed stocks or shares are taxed at 10 if they are held at least for a year. The CGT annual exempt amount therefore remains frozen at. Capital gains tax is a tax on the profit when a person sells something which has increased in value.

Capital gains tax is the government-determined tax that has to be paid on the profit from the sale of an asset. On the other hand similar returns from unlisted shares are taxed at 20 if the holding period is at least two years. The Income-tax I-T Act 1961 provides for taxation of income generated from the sale transfer of capital assets ie capital gains which include shares securities immovable.

Khan says he wants the government to raise the. This spread has led many taxpayers to deliberately create capital gains as a form of remuneration from their company. Combining Bidens proposed capital gains tax with the existing estate tax law which says that if you die with over 117 million in assets that amount is taxed once at a 40 rate some wealthy.

How much tax you pay depends on your level of income. The responsibility to pay capital gains tax arises on sale of a property or stock shares at a profit. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely.

Last years tax gains. Those cuts which would provide tax relief to seniors renters low-income families and lower the estate and capital gains tax would cost about 700 million according to estimates. 28 Apr 2022 1013 AM IST.

Capital Gains Tax Advice News Features Tips Kiplinger. The highest long-term capital gains rate would rise to 25 while the 38 Medicare surcharge for high-income investors would push that rate to 288. Check out for the latest news on capital gains tax along with.

This is expected to benefit. Basic-rate taxpayers pay 10 on profits and 18 on profits from second properties and higher-rate and additional-rate taxpayers pay 20 and 28 on property. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28.

The following Tax Rates have been prescribed under Income Tax Act for Capital Gain on the sale of Shares or Mutual Funds. Following a simplification review Capital Gains Tax CGT is an area that we have been expecting to hear some major announcements in but the Chancellor decided to leave things as they are with no changes being announced in the Spring Budget. Its important to note that Biden is also proposing a tax hikethat will raise the top income tax bracket from 37 to 396.

Labours Sadiq Khan wants an increase in Capital Gains Tax for some buy to let investors. 14 hours agoBreaking News. President Biden put forward a proposal to tax unrealized capital gainsincluding the appreciated values of homes business and stocks in taxable accountswhen the original owner dies a break.

News Capital Gains Tax Spring Budget 2022. Additionally a section 1250 gain the portion of a. Capital gains are the profit you earn from such a sale and capital gains tax is the tax you pay on that income.

For example if an individual taxpayer were to extract 1000000 of corporate funds as a capital gain instead of paying a non-eligible dividend the tax savings would be 210200. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase. Govt starts work to bring parity to long-term capital gains tax laws.

Long-term Capital Gain on equity shares listed on the recognized stock exchange or equity-oriented Mutual Funds on which STT is paid is taxed at 104 if the gain is above Rs 1 Lakh during the financial year. On April 7 2022 the Federal Budget will be released. The Finance Minister Nirmala Sitharaman announced the capping of the surcharge on the long term capital gains payable on capital assets at 15 percent.

Investors breathed a sigh of relief as a predicted hike in capital gains tax did not become reality in. The Center Square President Joe Bidens newly released 2023 budget included a tax provision that has come under extra scrutiny. Capital gains tax out of firing line in Budget.

The Democrats are also proposing to add a 3. This means that high-income single investors making over 523600 in tax year 2021 have to pay the top income tax bracket rate of 37. In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy.

What Is Short Term Capital Gains Tax Stcg Tax Budget News Short Term Capital Gains Tax Definition

How To Pay 0 Capital Gains Taxes With A Six Figure Income

House Democrats Propose Hiking Capital Gains Tax To 28 8

With The 2nd Year Of A Projected Budget Surplus Should California Consider Cutting Taxes The San Diego Union Tribune

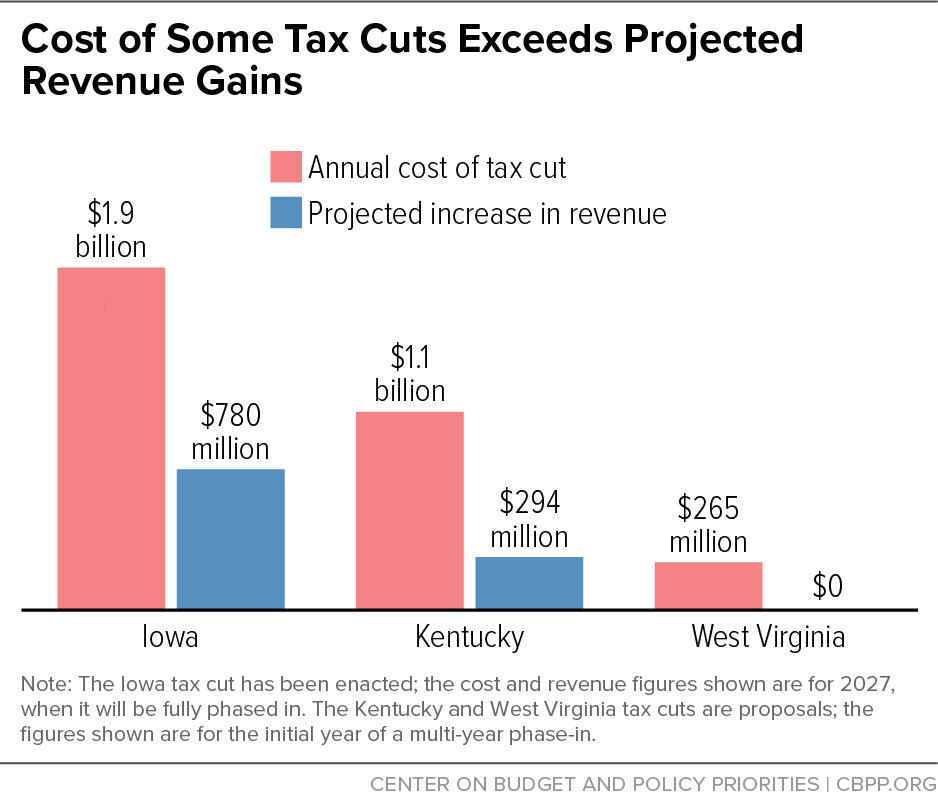

States With Temporary Budget Surpluses Should Invest In People Not Enact Permanent Tax Cuts Center On Budget And Policy Priorities

Long Term Capital Gain On Property Owner Critical Things To Know

Biden S Better Plan To Tax The Rich Wsj

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

Direct Tax Proposals In The Finance Bill 2021 Finance Tax Proposal

How To Save Capital Gains Tax On Property Sale Capital Gain Capital Gains Tax Tax

Analysis Of President Biden S 2023 Budget Center On Budget And Policy Priorities

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

How To Save Capital Gain Tax On Sale Of Residential Property

House Democrats Propose Hiking Capital Gains Tax To 28 8

Section 54 54f Income Tax Act Tax Exemption On Capital Gains

Income Tax Slabs To Change In Budget 2020 Some Countries With No Income Tax

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021